Five deposit strategies to consider as loan sizes rise higher

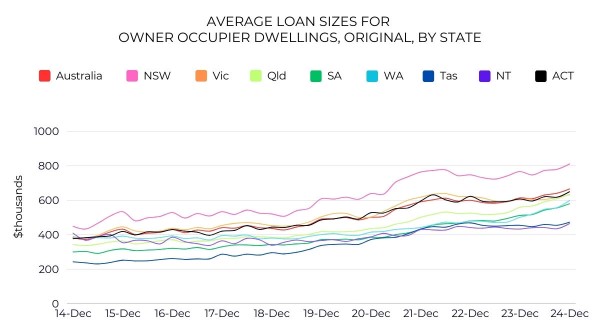

Owner-occupiers are stepping up in the property market as investors are stepping down, according to new data from the Australian Bureau of Statistics, while average loan sizes now range from $465,000 in the Northern Territory to $811,000 in New South Wales.

During the final three months of the year, loan commitments fell 4.5% quarter-on-quarter for investors while rising 2.2% for owner-occupiers, reflecting a changing dynamic in the market.

Meanwhile, the average mortgage across Australia reached a record $666,000 at the end of 2024, an increase of 8.5% on the year before.

Given those large loan sizes, accumulating a deposit can be hard. So here are five things you can do to either save your deposit faster or reduce the size of the deposit required:

- Ask me about borrowing strategies that require less than a 20% deposit

- Speak to your parents about a guarantor home loan, which could potentially reduce your share of the deposit to 5% or even 0%

- Consider buying in conjunction with a partner, relative or friend

- We can help with research for the Home Guarantee Scheme, which lets eligible buyers purchase a property with just a 5% deposit without having to pay lender’s mortgage insurance

- In WA we also have Keystart as an option with just 2% deposit without having to pay lender’s mortgage insurance

- Increase your savings rate, by looking for opportunities to cut your spending and grow your income

|