Increased supply across the housing continuum key to solving housing crisis

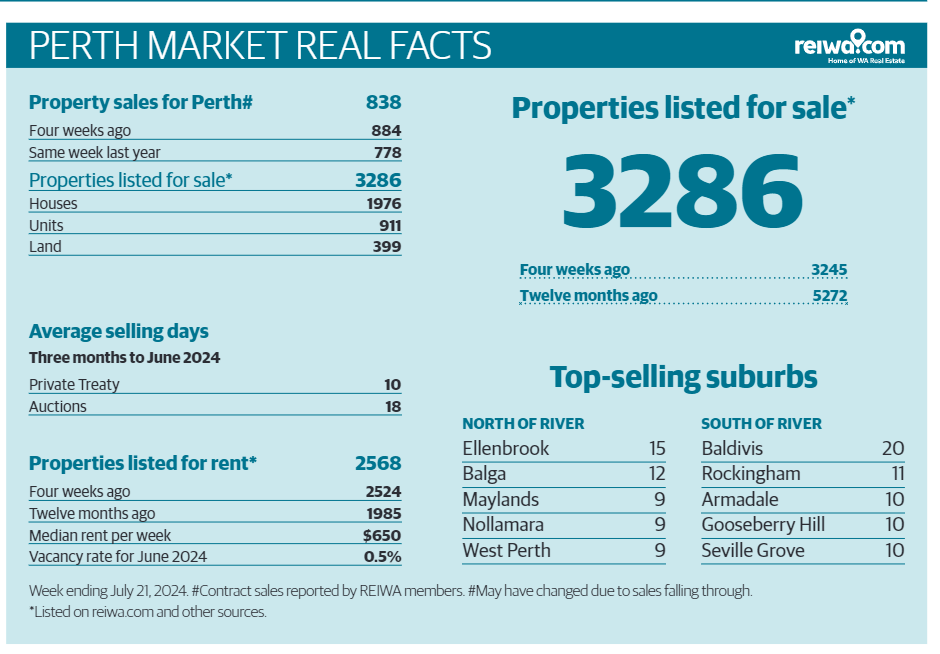

Without doubt housing is front and centre of public debate right now, right across the country. Keeping an eye on the availability of property to buy or rent is a great way to monitor when we might start to see light at the end of the tunnel. You can do this by taking a look at the REIWA “Perth Market Real Facts” which show the total number of properties sold for the week, the number of listings across houses, units and land and the number of advertised rentals and the median rent.

The REIWA stats week ending 21 July 2024 paint a relatively dire picture with just 1,976 houses and 911 units totalling just 2,887 available properties for sale across all of Perth. Available lots of land have plummeted in recent months with just 399 lots available for sale. With a total of 838 sales for the week, we are turning over 25% of the total stock each week! With these supply and demand metrics it is no wonder prices are continuing to escalate at a rapid rate. Until such time as we see total listings rise to a more stable 8,000 houses and units, pressure on prices will remain. The lack of available homes in the established market has seen a significant rush on land, with land releases generally selling out very soon after release and land developers really struggling to bring more supply to market as the large estates sell down their final stages.

The median rent in Perth has escalated strongly to $650 per week as rental vacancies continue to remain scarce. According to REIWA there were just 2,568 rentals available last week with a stubbornly low vacancy rate of 0.5%, the lowest in the country. Residential bonds held online at September last year was 215,000 which remains well below the 233,000 in June 2020 and yet we are recording the fastest population growth across the country. Some light at the end of the tunnel is that the median rental price has remained stable at $650 per week for a number of weeks.

Much has been made in the media about East Coast Investors creeping out local property buyers and we acknowledge that in some markets this added activity can further escalate pricing however the East Coast Investors that have been incredibly active in our greenfield markets purchasing house and land packages, have been a surrogate property developer assisting our industry to create much needed supply. These Investors were active long before Perth locals had regained confidence in our housing market and there is more recent evidence of some sales from early Investors to Owner Occupiers which I believe will continue in areas where vacancy rates rise. One thing we can be sure of, is these Investors are making their investment available in the rental market thereby assisting with the tight vacancy rate.

The new apartment market in Perth has faced its own set of challenges leading to very little new product getting off the ground due to record high construction costs, a severe lack of skilled labour as well as layers of policy and taxation that all add to the cost of a project, making many projects financially unviable without steep increases in end values. These increases in values are well and truly on their way with the most affordable end of the unit market the latest to rocket up in value. Take a look online and see how many older 1 x 1 and 2 x1 units in near city suburbs are available below $400,000. These units were selling in the low $200,000’s just 2 years ago. And whilst there has been incredibly strong demand from Investors in the greenfields this interest is only just materialising in the near city markets and so the pressure on rental stock close to the city remains off the chart. Recently Celsius advertised a 2 bed 2 bath 1 car bay apartment for rent in North Perth. This apartment was developed by Celsius and completed just 6 years ago when it was rented at $450 per week. Our PM team advertised the property at $675 per week, had 11 attend the first viewing and received 11 applications ranging from $675 – $720 per week. Our Property Manager Jess put forward 6 of the 11 applicants with the line “if only you had 6 of these apartments available as all of these applicants are absolutely perfect”

Celsius has been diligently working to provide housing supply across the continuum and presently has a pipeline of 535 lots of land across 4 estates including two in regional areas and 437 apartments across 4 developments in Subiaco, North Perth and Shenton Park. There are many developers just like Celsius working diligently to bring more supply to market. We all need the support of all levels of government as well as the community to ensure new supply is able to be brought to market as soon as possible. This is the only way to ensure the current price trajectory of the market is curtailed, so we don’t turn our relatively affordable housing market into a largely unaffordable market that brings with it a whole other set of challenges, especially for those not yet in the market.

All the best,

Richard